Fund Accounting

Navigate Complex Fund Structures with Precision. Our Fund Accounting Software is purpose-built for managing capitalized and unitized funds, Open-Ended or Close-Ended structures, supporting advanced capital flows, investor metrics, and multi-layered fee mechanics—all in one integrated platform.

Key Features

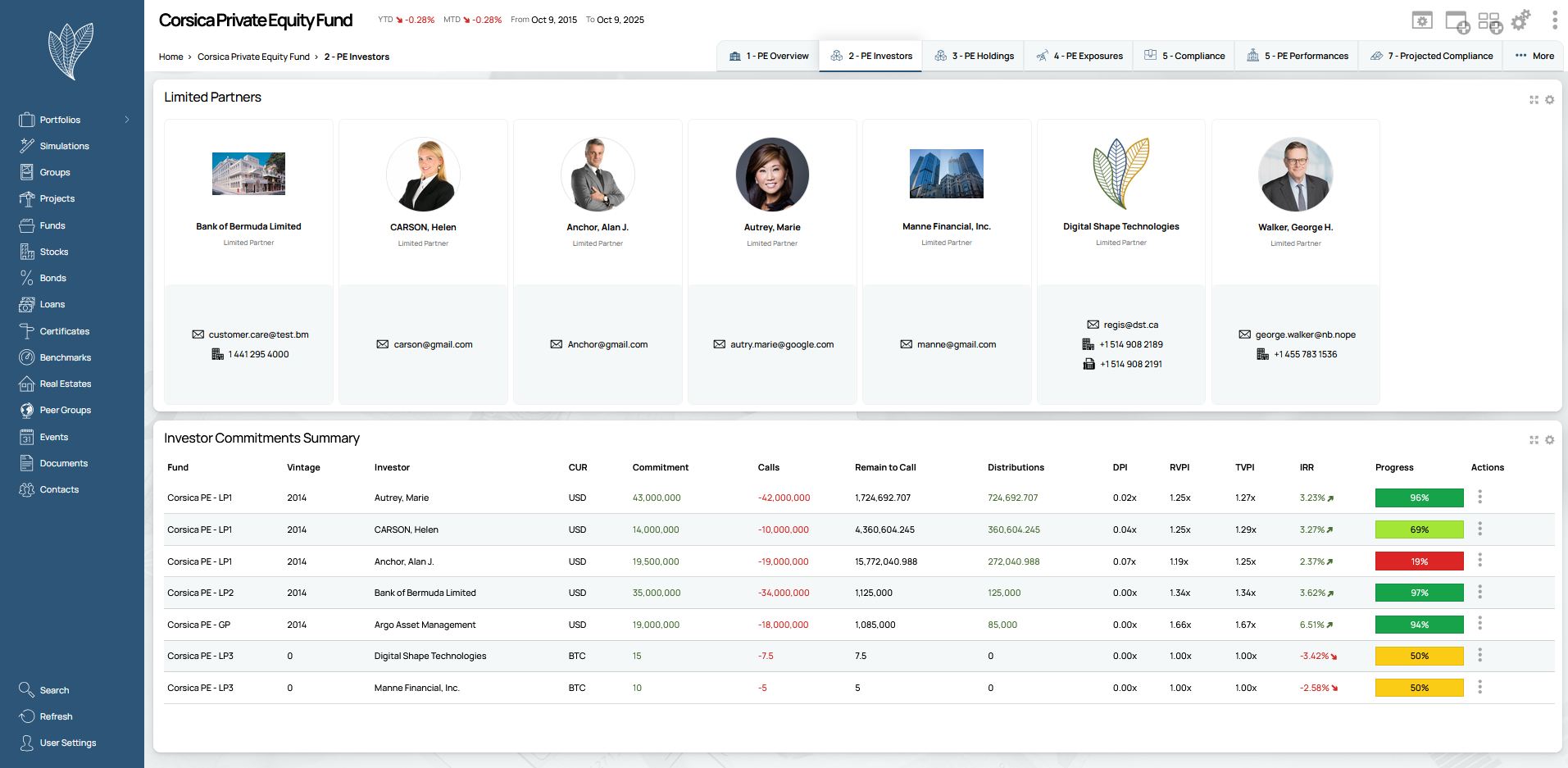

Investor Management & Commitment Tracking

Streamline investor onboarding, commitments, and lifecycle tracking.

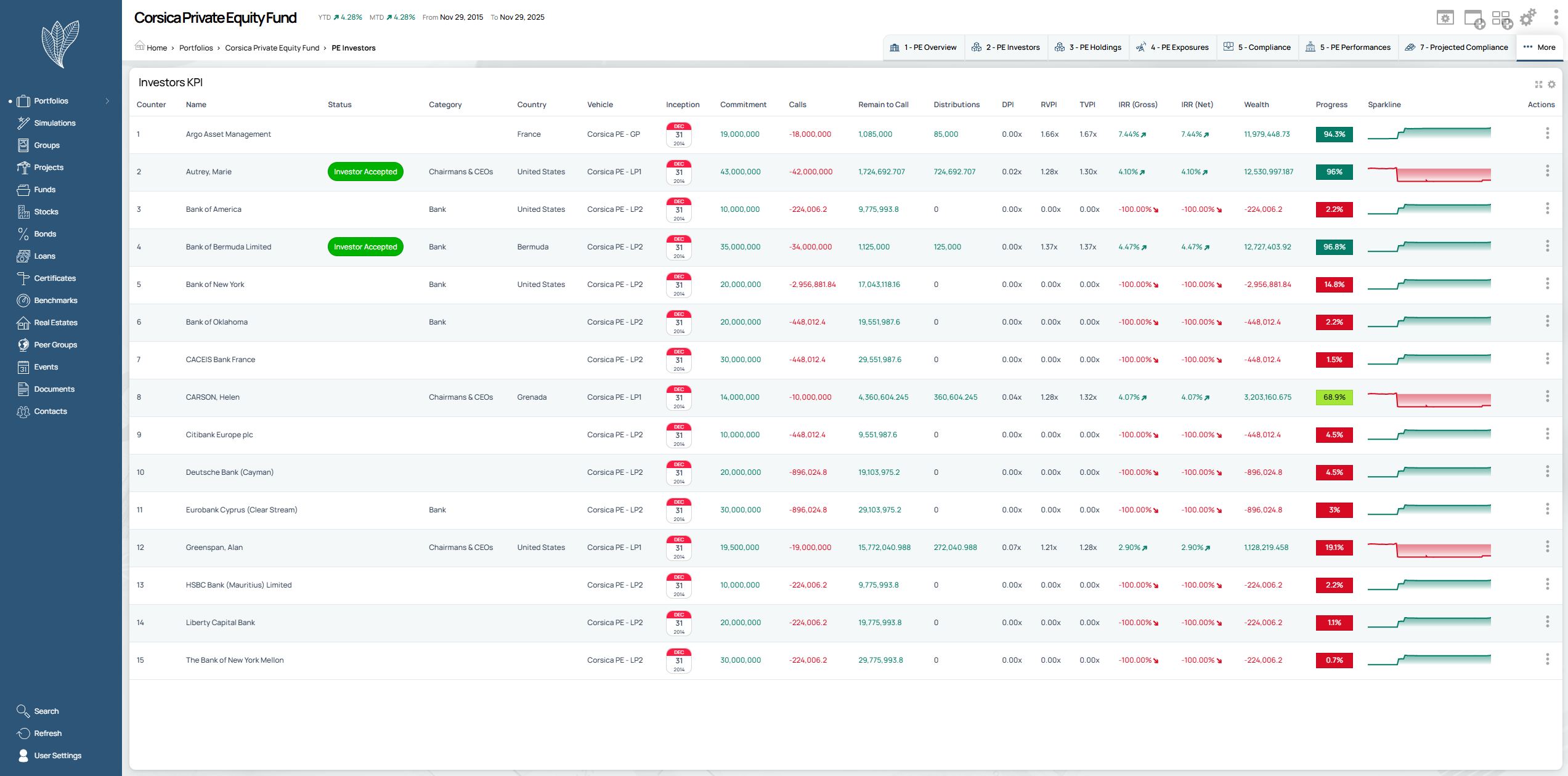

Investor-Level Performance Metrics

Deliver precise, investor-specific returns and private equity indicators.

Robust Valuation & NAV Automation

Confidently value every asset—liquid or not. Automate valuation workflows across complex portfolios.

Multi-Layer Fee & Expense Engine

Support complex and dynamic fee arrangements with precision.

Investor Management & Commitment Tracking

Streamline investor onboarding, commitments, and lifecycle tracking. Maintain complete oversight of each investor's position within complex fund structures.

Investor-Level Performance Metrics

Deliver precise, investor-specific returns and private equity indicators. Track personalized KPIs like IRR, TVPI, DPI, and RVPI with full transparency.

Robust Valuation & NAV Automation

Confidently value every asset—liquid or not. Automate valuation workflows across complex portfolios. From listed securities to illiquid assets, ensure consistency, transparency, and audit-readiness.

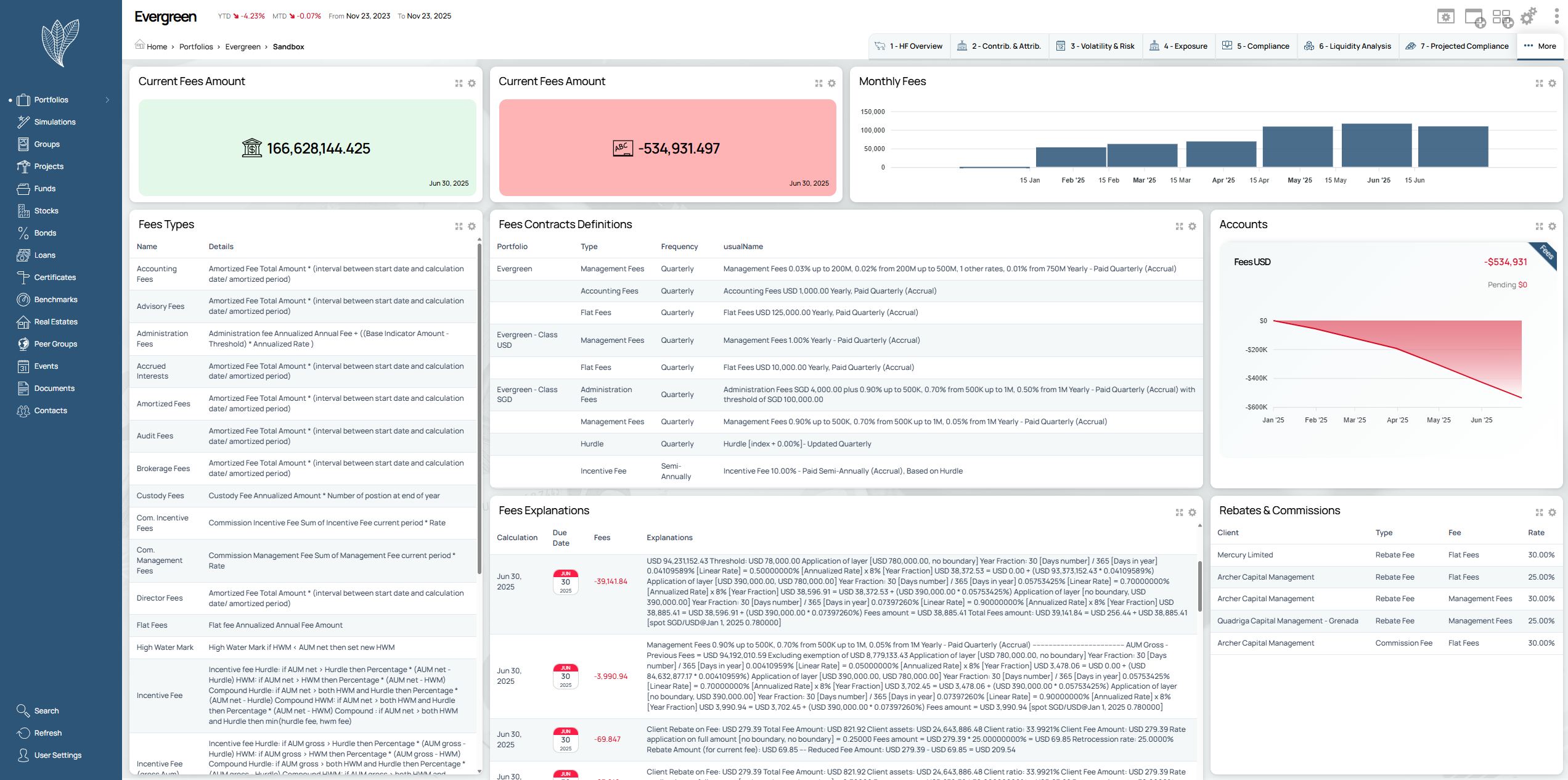

Multi-Layer Fee & Expense Engine

Support complex and dynamic fee arrangements with precision. Calculate management fees, carried interest, and expenses across varied fund structures.

- Support for a wide range of fee types, including flat fees, management fees, and incentive/performance fees (with support for hurdles and high-water marks, alone or in combination)

- Ability to configure fees at the share class level, with exception handling for specific investors, classes, or agreements

- Automatic fee accruals and expense allocations across funds, classes, and investors

- Ability to calculate and apply rebates to investors based on either total fees paid or total invested amounts

- Full visibility into underlying fee and rebate calculation formulas, assumptions, and methodologies

- Detailed fee and rebate reporting at the investor level, class level, and consolidated fund level

Ready to Take Your Investment Management to the Next Level?

Let us show you how Webfolio® can transform your operations, simplify your architecture, and elevate your client experience.